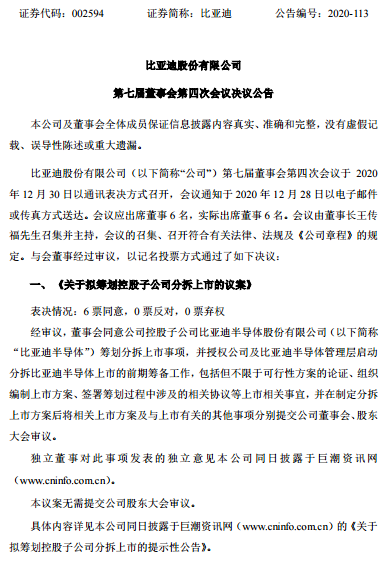

As 2020 is coming to an end, BYD Co., Ltd. (hereinafter referred to as “BYD Company”) once again released a “blockbuster”. BYD issued four announcements on the evening of December 30th, announcing that the company’s board of directors approved the proposal, BYD Semiconductor Co., Ltd. (hereinafter referred to as “BYD Semiconductor”) formally planned the spin-off and listing, and authorized the company and BYD Semiconductor’s management to start the spin-off. Preparatory work for split listing.

Specifically, the announcement mentioned that after deliberation, the board of directors agreed to the company’s holding subsidiary BYD Semiconductor to plan the spin-off and listing, and authorized the company and BYD Semiconductor’s management to start the preparatory work for the spin-off of BYD Semiconductor, including but not limited to the feasibility Demonstration of the plan, organizing the preparation of the listing plan, signing relevant agreements involved in the planning process and other listing-related matters, and submitting the relevant listing plan and other listing-related matters to the company’s board of directors and shareholders’ meeting for consideration after formulating the spin-off listing plan.

In addition, the independent directors of BYD Co., Ltd. stated in the “Independent Opinions on Matters Related to the Fourth Meeting of the Seventh Board of Directors” that they believe that matters such as the spin-off and listing of BYD Semiconductor are in line with the company’s strategic planning and long-term development, and there is no harm For the interests of the company and all shareholders, especially small and medium shareholders, after the initial determination of the listing plan, the company will perform the corresponding decision-making procedures in accordance with relevant laws and regulations, and review the relevant proposals for spin-off and listing. We agree with the company to start planning for the spin-off and listing of its holding subsidiary BYD Semiconductor, and authorize the company and the management of BYD Semiconductor to start preparations for the spin-off and listing.

In another announcement, it was also mentioned that this spin-off will not cause the company to lose control of BYD Semiconductor, will not have a substantial impact on the company’s continued operations of other business segments, and will not damage the company’s independent listing status. and sustainable profitability.

Why did BYD Semiconductor spin off and go public?

As we all know, “semiconductor” has become one of the important keywords for the development of the domestic technology industry in 2020, and it has also been the biggest problem of the domestic technology industry’s “stuck neck” for a long time. Due to the technical characteristics of the industry, the semiconductor industry has a large initial capital investment and a long construction period, which puts forward relatively high requirements on the financial strength and technological innovation capabilities of companies in the industry.

According to OFweek Electronic Engineering Network, BYD Semiconductor’s main business covers the R&D, production and sales of power semiconductors, intelligent control ICs, intelligent sensors and optoelectronic semiconductors, and has an integrated system including chip design, wafer manufacturing, packaging and testing and downstream applications. Operate the entire industrial chain. After more than ten years of research and development accumulation and large-scale application in the field of new energy vehicles, BYD Semiconductor has become a leading manufacturer of independent and controllable automotive-grade IGBTs in China. At the same time, in the field of industrial IGBT, the downstream applications of BYD Semiconductor’s products include industrial welding machines, frequency converters, home appliances, etc., which will bring new growth points to it.

Of course, IGBT is only part of BYD’s semiconductor business. In other business fields, BYD Semiconductor also has many years of R&D accumulation, sufficient technical reserves and rich product types, and has established long-term and close business relationships with customers from the automotive, consumer and industrial fields. In the future, BYD Semiconductor will focus on automotive-grade semiconductors, simultaneously promote the development of semiconductors in the fields of industry and consumption, and strive to grow into an efficient, intelligent, and integrated new semiconductor supplier.

Up to now, BYD Semiconductor has completed related work such as internal reorganization, equity incentives, introduction of strategic investors, and shareholding restructuring. The corporate governance structure and incentive system have continued to improve, industrial resources and reserve projects have been continuously enriched, and it has a good foundation for independent operations.

This spin-off and listing will help BYD Semiconductor further enhance its multi-channel financing capabilities and brand effect, form sustainable competitive advantages by strengthening resource integration capabilities and product research and development capabilities, make full use of the domestic capital market, grasp market development opportunities, and strive to become an efficient , Intelligent and integrated new semiconductor suppliers to lay a solid foundation.

Valuation tens of billions! What inspirations does the spin-off and listing of BYD Semiconductor bring to the domestic semiconductor industry?

In recent years, the state has intensively introduced relevant encouragement and support policies to increase support for the semiconductor industry from various aspects such as finance and taxation, investment and financing, research and development, import and export, talents, intellectual property rights, market applications, and international cooperation. As 5G communication technology promotes the development of innovative applications such as artificial intelligence and automotive electronics, the semiconductor market continues to expand. Under the background of policy support and superimposed market demand, the process of domestic substitution in the semiconductor industry is progressing steadily.

OFweek Electronic Engineering Network learned that as early as April 15 this year, BYD Company issued the “Announcement on the Reorganization of Wholly-owned Subsidiaries and the Introduction of Strategic Investors”, which mentioned that through the equity transfer and business transfer between subsidiaries Completed the internal restructuring of BYD Semiconductor. The announcement also revealed that BYD Semiconductor intends to introduce strategic investors by means of capital increase and share expansion, diversify the shareholder structure, enhance the company’s independence and help third-party customer expansion. At the same time, it will expand its capital strength, achieve capacity expansion, and accelerate business development.

As soon as the news was released at that time, there were many speculations in the industry that BYD Semiconductor might be spun off and listed. In the past 42 days alone, BYD announced that it has successfully introduced a strategic investment of 1.9 billion yuan. From the perspective of the industry, this is the pace of BYD Semiconductor speeding up its pursuit of independent listing.

On the evening of May 26, BYD issued an announcement stating that the company introduced 14 strategic investors in the form of capital increase and share expansion; among them, Sequoia Capital China Fund, CICC Capital and SDIC Innovation led the investment.

It is reported that according to the pre-investment valuation of BYD Semiconductor, this round of investors will increase the capital of BYD Semiconductor by a total of 1.9 billion yuan. Among them, RMB 76,050,058.65 million for the subscription of the target company is included in the newly added registered capital of BYD Semiconductor, and RMB 1,823,949,941.35 million is included in the capital reserve of BYD Semiconductor. A total of 20.2126% equity. After the completion of this capital increase and share expansion, the registered capital of the target company will be RMB 376,247,658.65 million.

After the end of this round of capital increase, the valuation of BYD Semiconductor has approached 10 billion yuan. The capital increase obtained by BYD Semiconductor is all used for the main business, including replenishment of working capital, purchase of assets, employment of personnel and research and development, and other purposes recognized by investors.

After BYD introduced 14 strategic investors in the form of capital increase and share expansion in May, on the evening of June 15, BYD Company announced again that BYD Semiconductor introduced a number of strategic investors in the form of capital increase and share expansion, including Hubei Xiaomi Changjiang 30 strategic investors including Industrial Fund Partnership, Hubei Lenovo Yangtze River Technology Industry Fund Partnership, and Shenzhen Country Garden Innovation Investment Co., Ltd.

It is reported that the second round of investors plans to increase the total capital of BYD Semiconductor by RMB 800 million according to the pre-investment valuation of the target company of RMB 7.5 billion. After the introduction of two rounds of strategic investors, the post-investment valuation of BYD Semiconductor has reached 10.2 billion yuan, and there is still room for further increase in future valuations.

Can the spin-off and listing of BYD Semiconductor bring any inspiration to the domestic semiconductor industry? Previously, OFweek Electronic Engineering Network had mentioned in the article “North and South Volkswagen Chip Shortage and Suspension: Behind the Exposure of Insufficient Domestic Chips” that due to the impact of the overseas epidemic, after the shutdown of chip factories, high-end chips for vehicles, mainly ESP and ECU chips, etc. Out of stock and out of stock, the import of corresponding parts was blocked, which led to the suspension of production. Most of the domestic automakers with mid-to-high-end models and above will be most affected. It is estimated that the affected production capacity will exceed one million vehicles in December.

BYD Semiconductor is about to be spun off and listed, with a valuation exceeding 10 billion

However, the shortage of foreign chips has affected the suspension of domestic automobile production. The problem behind it is that domestic automobile manufacturers generally rely on chip imports. Once the chip import channel is blocked, it will directly cause heavy damage to domestic automobile production. Looking at domestic vehicle manufacturers, except for BYD, which has its own chip production plant, most of the chips of car companies are supplied by third-party parts suppliers. At present, only the North and South Volkswagens are facing the problem of production suspension. Once the automotive chip market is out of stock on a large scale, it means that the entire industry will come to a standstill.

So this is why we say that the core market of global automotive semiconductor companies is in China, but Chinese local companies are in a weak position. The main reason is that semiconductor products are heavily dependent on imports.

Now it can be seen that compared with the previous entry into the CIS and fingerprint recognition market at a low price, BYD’s strategic positioning after the internal reorganization is more focused. BYD Semiconductor may focus on automotive-grade semiconductors in the future. Consumption and other fields are developing simultaneously, and while expanding product application fields, continue to increase market share. Looking at this situation, it is imperative for BYD Semiconductor to lead the domestic independent automotive chip industry.